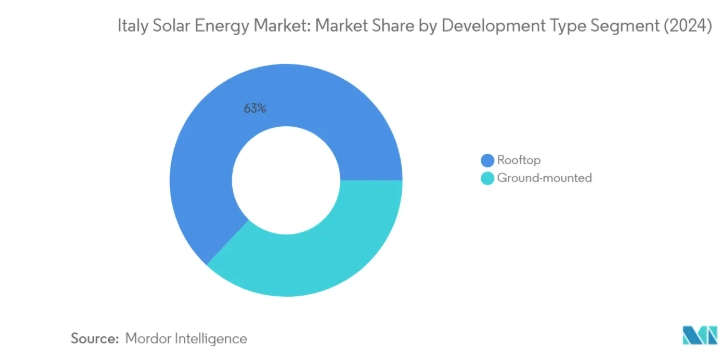

Rom, Juli 2025 – Der italienische Solarenergiemarkt steht vor einem deutlichen Wachstum. Prognosen deuten darauf hin, dass die installierte Kapazität von 38,53 Gigawatt (GW) im Jahr 2025 auf 65,57 GW bis 2030, was eine durchschnittliche jährliche Wachstumsrate (CAGR) von 11,221 TP3TDieses Wachstum wird durch eine Kombination aus steigenden Stromkosten, strengen staatlichen Maßnahmen und zunehmenden Unternehmensinvestitionen in große Solarprojekte vorangetrieben.

Markttreiber: Hohe Energiekosten und Bedenken hinsichtlich der Energiesicherheit

Italien hat seit langem mit einigen der höchsten Strompreise in Europa zu kämpfen. Privatkunden zahlen 0,319 € pro Kilowattstunde (kWh) Ende 2022. Diese hohen Kosten haben die Einführung von Solarenergie im privaten, gewerblichen und industriellen Sektor beschleunigt. Im Jahr 2021 machten erneuerbare Energien 43,321 TP3T des gesamten Strommix Italiens, wobei Solarenergie eine zentrale Rolle spielt.

Der Trend zu Eigenverbrauch hat ebenfalls an Zugkraft gewonnen, mit Photovoltaikanlagen Generierung 5.179 GWh Eigenverbrauch im Jahr 2021, repräsentiert 20,61 TP3T der gesamten SolarstromproduktionDieser Wandel unterstreicht die wachsende Präferenz für dezentrale Energielösungen bei Unternehmen und Haushalten, die ihre Abhängigkeit vom Stromnetz verringern möchten.

Große Solarprojekte und Agri-Photovoltaik auf dem Vormarsch

In Italien gibt es einen starken Anstieg an Solarprojekten im großen Maßstab. Agrivoltaik– ein Dual-Use-Ansatz, der Landwirtschaft mit Solarstromerzeugung kombiniert – zeichnet sich als wichtiger Trend ab. In März 2023begann Enel Green Power mit dem Bau des größten Solarparks Italiens, einem 170 MW Agrivoltaikanlage in Tarquinia, das darauf ausgelegt ist, die Landnutzung zu optimieren und gleichzeitig landwirtschaftliche Aktivitäten zu unterstützen.

Weitere wichtige Entwicklungen sind:

- Die Encavis AG Rahmenvereinbarung für eine 300-MW-Solarprojekt-Pipeline.

- Capital Dynamics Erwerb von drei Photovoltaik-Solarprojekten.

- Edisons 5 Milliarden Euro Investition zur Erweiterung der Solarkapazität auf 6 GW bis 2030.

Unternehmen Stromabnahmeverträge (PPAs) gewinnen ebenfalls an Dynamik. In September 2022, Sonnedix und Statkraft unterzeichneten eine 10-Jahres-PPA für 36 GWh Solarstrom jährlich, stammen aus Fabriken in Mittel- und Norditalien.

Regierungspolitik zur Beschleunigung der Solarenergienutzung

Die italienische Regierung hat eine Reihe von Maßnahmen ergriffen, um den Einsatz von Solarenergie zu beschleunigen, darunter:

- A Ziel von 70 GW neuer erneuerbarer Kapazität bis 2030, wie das Energie- und Umweltministerium in bekannt gab Februar 2023.

- Vereinfachte Genehmigung für kommerzielle Solaranlagen auf Dächern (50–200 kW), was eine schnellere Integration in Italiens Nettomessung („Scambio sul posto“) Schema.

- Steuerliche Anreize für Solaranlagen auf Dächern und Energieeffizienz in südlichen Regionen unter der DL Energia-Dekret (2023).

Darüber hinaus schließt sich Italien der Mandat der EU erfordern Solaranlagen auf Gewerbe-/Pvöffentliche Gebäude bis 2027 und Wohngebäude bis 2029Die nationale Energiestrategie zielt darauf ab, 72–74 TWh Solarstrom bis 2030, von 27,55 GWh im Jahr 2022 (A 24,61 TP3T Anstieg seit 2016).

Investitionsboom und Aufschwung in der heimischen Produktion

Italiens Solarsektor zieht erhebliche Investitionen an:

- Solarig und Alantra startete eine 1,7 Milliarden Euro Investitionsvehikel Zielsetzung 1,9 GW Photovoltaik, die Hälfte davon in Italien.

- UniCredit und Enel Partnerschaft zur Erweiterung eines Solarmodulfabrik in Catania, wodurch die Produktion von 200 MW bis 3 GW jährlich.

Herausforderungen und Zukunftsaussichten

Trotz des starken Wachstums steht Italien vor Hürden wie bürokratische Verzögerungen bei der Genehmigung und Landnutzungskonflikte. Das Bestreben der Regierung nach schnellere Genehmigungen und innovative Lösungen wie Agrivoltaik Diese Herausforderungen sollen gemildert werden.

Mit steigende PPAs für Unternehmen, unterstützende Richtlinien und technologische Fortschritteist Italiens Solarmarkt auf dem besten Weg, ein Europäischer Marktführer im Bereich erneuerbare Energien. Der Übergang verbessert nicht nur die Energiesicherheit, sondern positioniert Italien auch als Schlüsselakteur in der Die grünen Energieambitionen der EU.