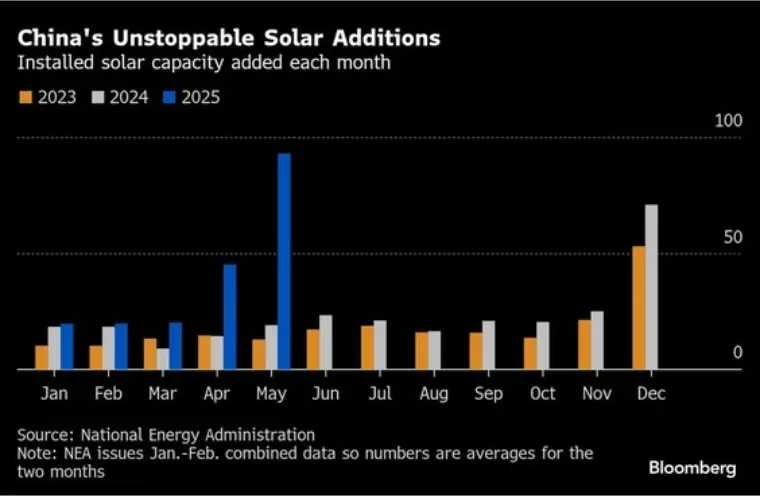

June 26, 2025 – China’s solar power sector witnessed an unprecedented installation surge in May 2025, adding a staggering 93 gigawatts (GW) of new capacity, according to data released by the National Energy Administration (NEA). This represents a year-on-year increase of nearly 388% and is equivalent to one-third of the entire country’s solar installations for the whole of 2024 (278 GW).

Stunning Growth Trajectory

The NEA data reveals that total solar installations for the first five months of 2025 reached approximately 198 GW. This growth accelerated dramatically in April and May:

- April 2025: 45 GW added (+215% YoY), setting a record for the highest monthly installation volume ever seen in the first half of a year (Dongxing Securities).

- May 2025: 93 GW added (+388% YoY), shattering the previous month’s record.

This explosive growth in just two months (138 GW) significantly outpaced installations during the first quarter. CITIC Securities research highlights that China added 141 GW of total power capacity (including all sources) from January to April, with solar contributing 105 GW – a 74.6% YoY increase for the sector.

Policy Catalyst: The “630” Deadline Rush

Industry analysts universally attribute this surge primarily to a crucial policy shift. In February 2025, the National Development and Reform Commission (NDRC) and the NEA issued the Notice on Deepening the Market-Oriented Reform of New Energy Feed-in Tariffs to Promote High-Quality Development of New Energy.

The policy established distinct rules based on project commissioning dates:

- Projects Commissioned BEFORE June 1, 2025: Qualify for a settled tariff via a “difference payment” mechanism, ensuring alignment with existing policies and capped at the local coal-fired power benchmark price. This provides relative pricing certainty.

- Projects Commissioned ON or AFTER June 1, 2025: Face a new mechanism where the volume of electricity eligible for subsidies is dynamically adjusted based on regional renewable energy targets, and the subsidy tariff itself must be determined through competitive market bidding. This introduces significant uncertainty over future project returns.

Faced with the prospect of potentially lower and less predictable revenues for projects connected after June 1st, developers initiated a massive “grid connection rush” to lock in the more favorable pre-June tariff terms. This phenomenon, often termed the “630 effect” due to the mid-year deadline, reached unprecedented intensity in 2025.

Market Jitters: Is Demand Being Pulled Forward?

The scale of the April-May installations has ignited widespread concern within the industry about potential “demand cannibalization” – the fear that this extraordinary activity has simply pulled forward projects originally planned for the second half of 2025 or even 2026, leaving a significant void in future demand.

Evidence supporting these concerns is emerging from the upstream supply chain:

- Component Production: After robust increases in March (+41.1% MoM) and April (+16.5% MoM), data from Shanghai Metals Market (SMM) shows a significant reversal in May, with component output falling approximately 12.7% month-on-month as manufacturers began cutting production.

- June Outlook: SMM forecasts a further decline in June output. They attribute this to a sharp drop in distributed solar demand post-deadline, with only some support from the commercial & industrial segment and significant uncertainty around utility-scale projects. Market research firm InfoLink Consulting corroborates this, estimating June component output at only around 53 GW (down from ~59 GW in May), describing June-July as potentially “a distinctly different low season.”

“Grid connection activities concentrated at the end of Q2 have substantially consumed market demand originally expected for the second half,” stated SMM in its analysis. “The overall pressure on the demand side in H2 could be significant.”

InfoLink further warned of weak demand signals persisting into August, with manufacturers struggling to secure new orders. They anticipate insufficient price support for components, leading to potential further price declines.

A Glimmer of Mitigation? The “Pre-Registration” Factor

While acknowledging the demand pull-forward risk, industry sources point to a potential mitigating factor: the prevalence of “pre-registration” or “declare first, install later” practices in May. This means some projects reported as “grid-connected” in May to meet the deadline may not have been fully physically installed, with components yet to be delivered and commissioned.

Mao Tingting, Senior SMM Photovoltaic Analyst, explained to the Daily Economic News: “Currently, some projects reported in May involve pre-registration. The components for these projects haven’t necessarily been shipped yet, which could provide some support for component demand in the third quarter. Therefore, it’s also a case of the installation data reflecting activity ahead of the physical completion.” This suggests a portion of the reported May surge represents administrative compliance rather than immediate, fully realized demand, potentially leaving a residual pipeline for Q3 installations.

Balancing the Boom: Opportunities and Challenges Ahead

China’s solar installation surge underscores both the sector’s massive potential and its continued sensitivity to policy frameworks. The clear signal for rapid decarbonization is positive. However, the extreme volatility induced by the policy transition creates significant challenges:

- Supply Chain Disruption: The rapid boom-bust cycle strains manufacturers, leading to production volatility and potential financial instability.

- Grid Integration: Absorbing such massive, concentrated capacity additions poses immense challenges for grid infrastructure and stability.

- Long-Term Planning: Extreme short-term policy-driven surges hinder predictable long-term industry planning and investment.

The coming months will be critical. The industry and policymakers will closely watch whether the potential pipeline from pre-registered projects materializes sufficiently to avoid a deep Q3 slump, and how effectively the new market-based subsidy mechanism for post-June projects takes hold. Navigating this transition smoothly is crucial for sustaining the long-term, high-quality growth of the world’s largest solar market.