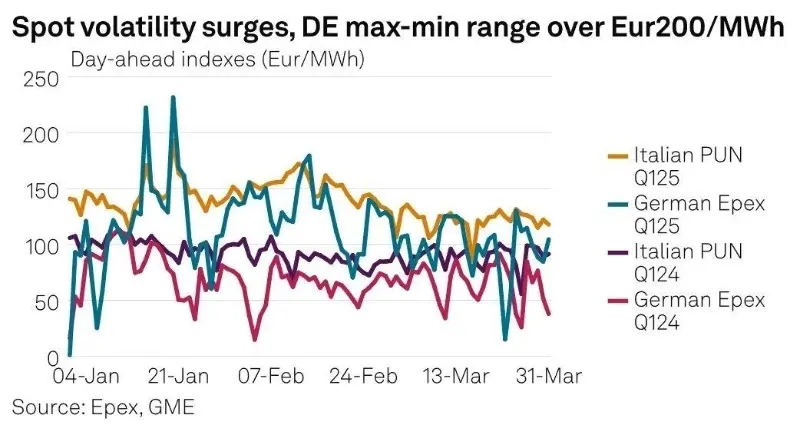

In the first quarter of 2025, volatility in the European spot electricity market surged significantly. Data shows that the average standard deviation of day-ahead electricity prices in the five major European power markets reached €33.47/MWh—an 85% increase compared to the same period in 2024. Germany stood out in particular, with hourly prices peaking at a historic €583.40/MWh on January 20. Negative electricity prices also became more frequent, with 44 hours of negative pricing recorded in Q1 alone.

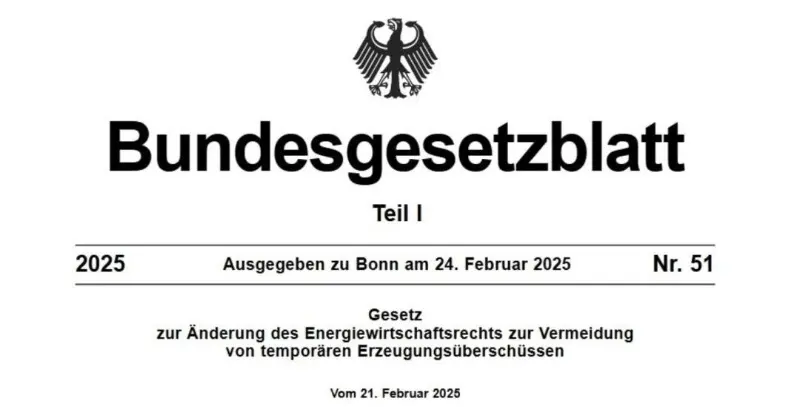

Amidst Europe’s ongoing carbon neutrality transition, the renewable energy sector is undergoing profound structural changes. Energy storage systems (ESS) have emerged as critical infrastructure for enhancing grid flexibility and balancing supply and demand. Germany’s new Solar Package I, introduced in 2024 and effective from March 2025, formally abolishes feed-in subsidies during periods of negative electricity prices. The policy aims not only to ease fiscal pressure on Germany’s EEG (Renewable Energy Act) account, but more importantly, to send more accurate market signals and unlock growth potential for the European energy storage industry.

This article analyzes the underlying logic and broader implications of Germany’s policy shift from four perspectives: policy drivers, technological progress, market dynamics, and opportunities and challenges for Chinese enterprises.

I. Policy Drivers: Empowering Energy Storage’s Market Role

Germany’s Solar Package I focuses on removing subsidies for PV systems during negative pricing periods and introduces the following complementary measures:

Optimized Compensation: Newly installed PV systems are no longer eligible for feed-in tariffs during negative price periods but may receive compensation of €0.006/kWh or have their subsidy period extended to offset expected revenue loss.

Mandatory Smart Metering: PV systems over 7kW must install smart metering systems (iMSys), or their output will be limited to 60% of maximum capacity—aiming to improve grid intelligence.

Exemption for Systems with Storage: PV systems equipped with energy storage are exempt from output restrictions, encouraging investment in storage to absorb excess electricity.

These policies respond to structural challenges in Germany’s power market. In 2024, negative pricing lasted 457 hours—over 5% of the year—revealing the mounting grid pressure caused by rapid renewable energy growth. By eliminating subsidies during these periods, the government intends to use market-based mechanisms to discourage overproduction while creating value for energy storage systems, which can store excess electricity during low-price periods and release it during high demand.

At the EU level, supportive policies are also taking shape. The REPowerEU plan raises the 2030 renewable energy target to 45% and introduces tools such as capacity markets and storage-specific auctions. Member states are responding: Italy is rapidly deploying utility-scale storage through capacity auctions, while the UK’s T-4 market offers stable returns for investors.

II. Technological Advancements: From Cost Reduction to Value Creation

Policy incentives are accelerating technological innovation and scenario diversification.

Germany’s adoption of 15-minute settlement intervals enables ESS to engage in intraday high-frequency trading and load balancing via AI-powered platforms. While lithium iron phosphate (LFP) batteries currently dominate short-duration applications due to cost advantages, they face limitations in thermal management and cycle life, necessitating technical upgrades.

Simultaneously, long-duration energy storage (LDES) is filling market gaps. Projects such as Scotland’s Orkney gravity storage and Germany’s Shaki thermal storage have passed commercial validation, addressing needs beyond four hours of discharge. In the future, hybrid systems combining short-duration lithium storage with long-duration technologies will become the standard for diversified grid applications.

III. Market Dynamics: Structural Divergence and Opportunity Realignment

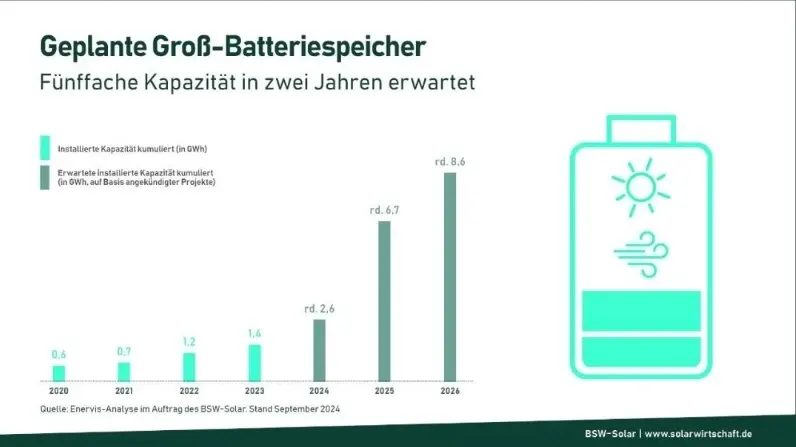

Germany’s utility-scale storage sector is booming. In 2024, new installations reached 800MWh, up 83% year-on-year, driven by a rise in wind and solar penetration to 44%. Arbitrage and frequency regulation returns have improved, prompting capital inflows. Projections show that new installations could exceed 1GWh in 2025 and reach 8.6GWh by 2026—placing Germany among Europe’s top storage markets.

Meanwhile, Europe’s energy storage sector is experiencing structural divergence:

Residential Storage Contraction: Residential installations declined 27% year-on-year in 2024, affected by falling electricity prices and inventory backlogs. In Germany, lower retail electricity prices have extended payback periods for PV-plus-storage systems. However, supportive policies (e.g., VAT exemptions in Austria, zero-interest loans in multiple countries) are expected to modestly revive demand in 2025.

Utility-Scale Storage Boom: Europe added 11GWh of utility-scale storage in 2024. Italy achieved exponential growth through capacity auctions, while the UK approved 3.7GWh of projects via streamlined permitting.

This shift is driven by two main factors: grid integration pressure in countries with high renewable penetration (e.g., over 90% instantaneous penetration in Denmark and Ireland) and innovative market mechanisms such as 15-minute settlements and virtual power plant (VPP) adoption. Germany’s policy enhances the value of storage, accelerating this trend further.

III. Market Dynamics: Structural Divergence and Opportunity Realignment

Germany’s utility-scale storage sector is booming. In 2024, new installations reached 800MWh, up 83% year-on-year, driven by a rise in wind and solar penetration to 44%. Arbitrage and frequency regulation returns have improved, prompting capital inflows. Projections show that new installations could exceed 1GWh in 2025 and reach 8.6GWh by 2026—placing Germany among Europe’s top storage markets.

Meanwhile, Europe’s energy storage sector is experiencing structural divergence:

Residential Storage Contraction: Residential installations declined 27% year-on-year in 2024, affected by falling electricity prices and inventory backlogs. In Germany, lower retail electricity prices have extended payback periods for PV-plus-storage systems. However, supportive policies (e.g., VAT exemptions in Austria, zero-interest loans in multiple countries) are expected to modestly revive demand in 2025.

Utility-Scale Storage Boom: Europe added 11GWh of utility-scale storage in 2024. Italy achieved exponential growth through capacity auctions, while the UK approved 3.7GWh of projects via streamlined permitting.

This shift is driven by two main factors: grid integration pressure in countries with high renewable penetration (e.g., over 90% instantaneous penetration in Denmark and Ireland) and innovative market mechanisms such as 15-minute settlements and virtual power plant (VPP) adoption. Germany’s policy enhances the value of storage, accelerating this trend further.

IV. Challenges and Opportunities: Strategic Positioning for Chinese Enterprises

Germany’s prolonged negative pricing periods in 2024 paradoxically highlighted the economic value of storage. Under the new rules, ESS can store grid electricity during negative pricing and profit from peak-hour resale. This creates a three-layered revenue model: arbitrage, ancillary services, and capacity leasing. Aurora Energy estimates that by 2030, widespread ESS deployment could reduce Germany’s negative pricing hours to under 100 per year while unlocking €2.7 billion in new annual market value.

Nevertheless, several hurdles remain:

Technical Upgrades: Existing systems must integrate smart metering and remote-control capabilities, with retrofitting costs estimated at €870 million.

Supply Chain Pressure: The EU’s Carbon Border Adjustment Mechanism (CBAM) imposes a 4.2% surcharge on batteries with a carbon footprint above 58kg CO₂/kWh, encouraging localized production.

Infrastructure Bottlenecks: Aging grid infrastructure leads to project approval cycles of up to 18 months, hindering timely deployment.

However, these challenges also bring opportunities. Co-location of solar and storage systems is expanding rapidly under supportive policies. The UK’s TNUoS congestion zones and Germany’s underdeveloped southern grid regions have become key investment targets. Chinese enterprises, leveraging cost advantages and technological maturity, are making inroads through differentiated competition.

Looking ahead, success in Europe will hinge on “technical compliance + commercial agility”. From 2025, Germany will require PV and storage devices to be registered in the ZEREZ system, raising the entry bar. Chinese firms must intensify efforts in thermal management, AI-driven optimization, and localized services to gain a competitive edge against European and global players.

Conclusion: From Subsidy Thinking to Market Logic

Germany’s removal of negative pricing subsidies is not merely a fiscal adjustment—it marks a fundamental regulatory transformation. It accelerates the convergence of policy, market, and technology, shifting energy storage from a supporting role to a central pillar of the power system.

As Europe moves from “subsidy-driven” to “market-driven” renewable energy, the winners will be those who can quickly adapt to policy shifts, match diverse market scenarios, and deliver ongoing innovation and local service. For Chinese enterprises, this is both a formidable challenge and a rare strategic opportunity to build global leadership.

As Europe moves from “subsidy-driven” to “market-driven” renewable energy, the winners will be those who can quickly adapt to policy shifts, match diverse market scenarios, and deliver ongoing innovation and local service. For Chinese enterprises, this is both a formidable challenge and a rare strategic opportunity to build global leadership.